library(tidyverse)

library(dplyr)

library(caret)

library(ggplot2)

library(e1071)

cc <- read.csv('consumer_complaints.csv')Complaint Classifier

As part of my Data Mining coursework, I’m building a Naive Bayes classification model to predict whether a consumer disputes a company’s response using the Consumer Complaints dataset. The project involves cleaning and preprocessing the data, including renaming variables, removing redundancies, and binning categories. I evaluate the model’s performance using confusion matrices and compare it to the naive rule, uncovering key insights into the challenges of predicting dispute outcomes and how predictions can be improved.

The source of dataset is Kaggle.

Data Exploration

Numeric: Resolution.time.in.days, Year

Categorical: X.ID

glimpse(cc)Rows: 14,000

Columns: 16

$ X.ID <int> 1615767, 654223, 1143398, 1303679, 1627370, 1…

$ Company <chr> "PHH Mortgage", "Ocwen", "Southwest Credit Sy…

$ Product <chr> "Mortgage", "Mortgage", "Debt collection", "C…

$ Issue <chr> "Loan servicing, payments, escrow account", "…

$ State <chr> "FL", "NC", "MO", "WA", "VA", "IL", "FL", "OK…

$ Submitted.via <chr> "Web", "Web", "Web", "Web", "Web", "Web", "We…

$ Date.received <chr> "10/20/2015", "3/1/2014", "4/12/2014", "03/26…

$ Date.resolved <chr> "10/20/2015", "3/1/2014", "4/12/2014", "03/26…

$ Timely.response. <chr> "Yes", "Yes", "Yes", "Yes", "Yes", "Yes", "Ye…

$ Consumer.disputed. <chr> "No", "No", "No", "No", "No", "No", "No", "No…

$ state.name <chr> "Florida", "North Carolina", "Missouri", "Was…

$ Date.received.1 <chr> "10/20/2015", "1/3/2014", "12/4/2014", "3/26/…

$ Date.resolved.1 <chr> "10/20/2015", "1/3/2014", "12/4/2014", "3/26/…

$ Resolution.time.in.days. <int> 0, 0, 0, 0, 0, 0, 1, 0, 0, 0, 5, 0, 0, 29, 0,…

$ Year <int> 2015, 2014, 2014, 2015, 2015, 2015, 2016, 201…

$ QTR..US.FLY. <chr> "Q4", "Q1", "Q4", "Q1", "Q4", "Q2", "Q2", "Q2…Consumer.disputed. variable is of type chr, then I converted it to factor. Now it has 2 levels: Yes or No.

We see that the data is imbalanced, out of 14,000 complaints only 3138 (22.4%) disputed.

str(cc$Consumer.disputed.) chr [1:14000] "No" "No" "No" "No" "No" "No" "No" "No" "No" "No" "No" "No" ...cc$Consumer.disputed. <- factor(cc$Consumer.disputed.)

levels(cc$Consumer.disputed.)[1] "No" "Yes"table(cc$Consumer.disputed.)

No Yes

10862 3138 cc %>% group_by(Consumer.disputed.) %>%

summarise(Count = n()/14000)# A tibble: 2 × 2

Consumer.disputed. Count

<fct> <dbl>

1 No 0.776

2 Yes 0.224I removed dots from variables that had them at the end, and renamed QTR..US.FLY. to Quarter.

names(cc) [1] "X.ID" "Company"

[3] "Product" "Issue"

[5] "State" "Submitted.via"

[7] "Date.received" "Date.resolved"

[9] "Timely.response." "Consumer.disputed."

[11] "state.name" "Date.received.1"

[13] "Date.resolved.1" "Resolution.time.in.days."

[15] "Year" "QTR..US.FLY." cc <- cc %>% rename(Resolution.time.in.days = Resolution.time.in.days.,

Timely.response=Timely.response.,

Consumer.disputed=Consumer.disputed.,

Quarter = QTR..US.FLY.)After examining number of unique values in each column, we observe that a few columns contain more than 100 distinct values. Specifically, there are 14,000 unique ID records, 1,050 companies, and over 1,300 date values.

sapply(cc, function(x) length(unique(x))) X.ID Company Product

14000 1050 12

Issue State Submitted.via

81 60 5

Date.received Date.resolved Timely.response

1370 1322 2

Consumer.disputed state.name Date.received.1

2 52 1370

Date.resolved.1 Resolution.time.in.days Year

1322 77 4

Quarter

4 cc <- cc %>% select(-X.ID, -Company, -Date.received, -Date.resolved, -Date.received.1, -Date.resolved.1)

str(cc)'data.frame': 14000 obs. of 10 variables:

$ Product : chr "Mortgage" "Mortgage" "Debt collection" "Credit card" ...

$ Issue : chr "Loan servicing, payments, escrow account" "Loan servicing, payments, escrow account" "Loan modification,collection,foreclosure" "Billing statement" ...

$ State : chr "FL" "NC" "MO" "WA" ...

$ Submitted.via : chr "Web" "Web" "Web" "Web" ...

$ Timely.response : chr "Yes" "Yes" "Yes" "Yes" ...

$ Consumer.disputed : Factor w/ 2 levels "No","Yes": 1 1 1 1 1 1 1 1 1 1 ...

$ state.name : chr "Florida" "North Carolina" "Missouri" "Washington" ...

$ Resolution.time.in.days: int 0 0 0 0 0 0 1 0 0 0 ...

$ Year : int 2015 2014 2014 2015 2015 2015 2016 2015 2013 2016 ...

$ Quarter : chr "Q4" "Q1" "Q4" "Q1" ...By examining the results of the summary() function, we notice an impossible negative number for the resolution date. Additionally, there are two overlapping columns: State and State_name.

summary(cc) Product Issue State Submitted.via

Length:14000 Length:14000 Length:14000 Length:14000

Class :character Class :character Class :character Class :character

Mode :character Mode :character Mode :character Mode :character

Timely.response Consumer.disputed state.name

Length:14000 No :10862 Length:14000

Class :character Yes: 3138 Class :character

Mode :character Mode :character

Resolution.time.in.days Year Quarter

Min. : -1.000 Min. :2013 Length:14000

1st Qu.: 0.000 1st Qu.:2014 Class :character

Median : 0.000 Median :2015 Mode :character

Mean : 2.006 Mean :2015

3rd Qu.: 2.000 3rd Qu.:2016

Max. :286.000 Max. :2016 Before that, when counting unique values by column, we observed that the State column had 60 unique values, while the State_name column had 52. Upon examining the values, it appears that the State column includes more detailed information, possibly encompassing territories and military postal codes. We can also keep Year, Resolution.time.in.days, and Quarter, which are related to the removed columns date_received, and date_resolved.

table(cc$State)

AA AE AK AL AP AR AS AZ CA CO CT DC DE FL GA

110 1 5 19 135 4 62 1 313 1977 251 161 98 80 1255 577

GU HI IA ID IL IN KS KY LA MA MD ME MI MN MO MP

1 39 56 51 500 137 78 99 149 292 408 47 373 174 171 1

MS MT NC ND NE NH NJ NM NV NY OH OK OR PA PR RI

77 19 443 7 54 65 518 75 171 996 463 93 177 511 26 64

SC SD TN TX UT VA VI VT WA WI WV WY

194 26 238 1040 77 480 8 29 303 178 32 11 cc <- cc %>% select(-state.name) %>%

filter(Resolution.time.in.days>=0)

str(cc)'data.frame': 13997 obs. of 9 variables:

$ Product : chr "Mortgage" "Mortgage" "Debt collection" "Credit card" ...

$ Issue : chr "Loan servicing, payments, escrow account" "Loan servicing, payments, escrow account" "Loan modification,collection,foreclosure" "Billing statement" ...

$ State : chr "FL" "NC" "MO" "WA" ...

$ Submitted.via : chr "Web" "Web" "Web" "Web" ...

$ Timely.response : chr "Yes" "Yes" "Yes" "Yes" ...

$ Consumer.disputed : Factor w/ 2 levels "No","Yes": 1 1 1 1 1 1 1 1 1 1 ...

$ Resolution.time.in.days: int 0 0 0 0 0 0 1 0 0 0 ...

$ Year : int 2015 2014 2014 2015 2015 2015 2016 2015 2013 2016 ...

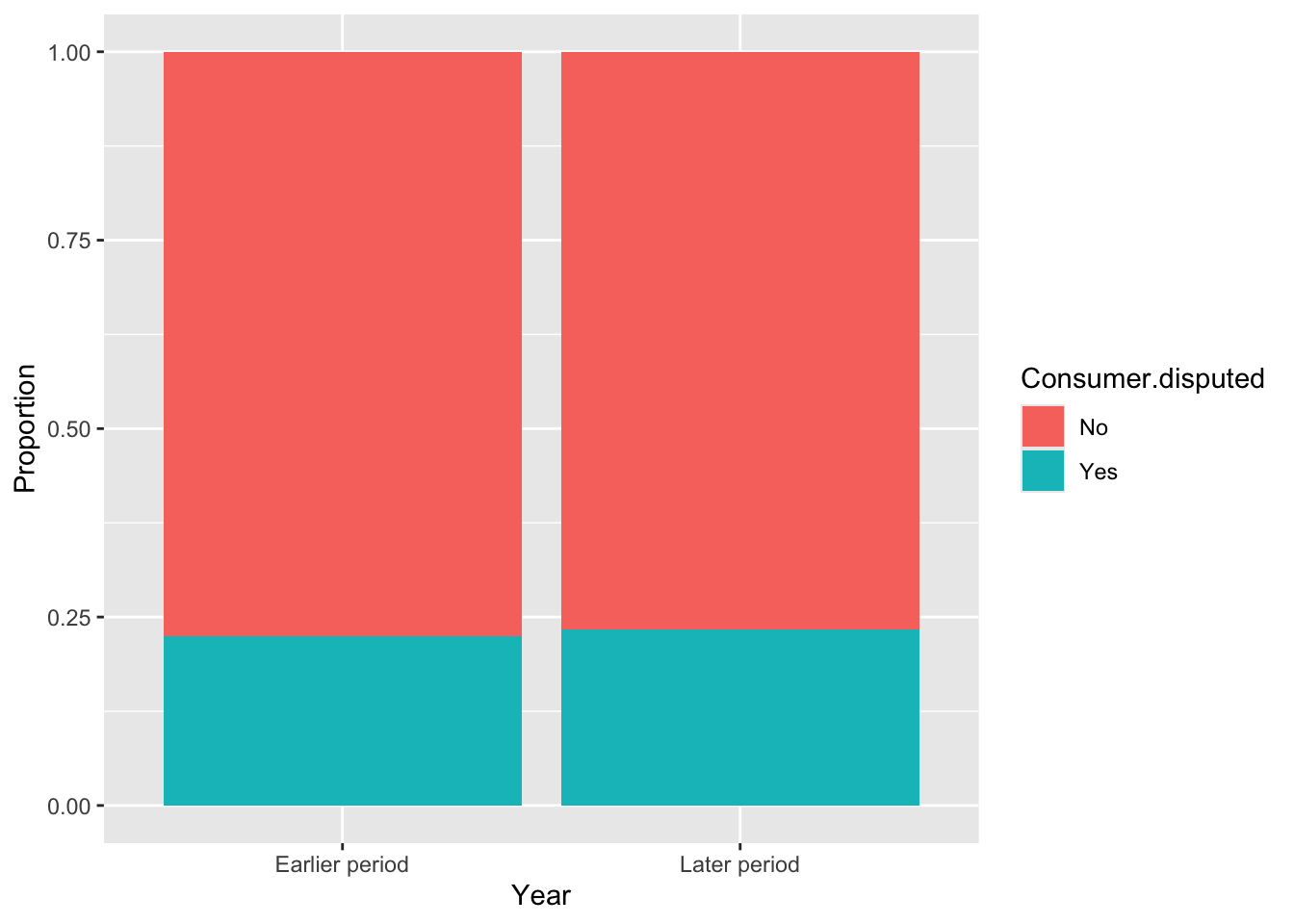

$ Quarter : chr "Q4" "Q1" "Q4" "Q1" ...The Year column contains four unique values: 2013, 2014, 2015, and 2016. For binning, we can group them into two categories: ‘Earlier period’ for 2013 and 2014, and ‘Later period’ for 2015 and 2016.

cc <- cc %>%

mutate(Year = cut(Year,

breaks = c(2012, 2014, 2016),

labels = c("Earlier period", "Later period"),

right = TRUE))

str(cc)'data.frame': 13997 obs. of 9 variables:

$ Product : chr "Mortgage" "Mortgage" "Debt collection" "Credit card" ...

$ Issue : chr "Loan servicing, payments, escrow account" "Loan servicing, payments, escrow account" "Loan modification,collection,foreclosure" "Billing statement" ...

$ State : chr "FL" "NC" "MO" "WA" ...

$ Submitted.via : chr "Web" "Web" "Web" "Web" ...

$ Timely.response : chr "Yes" "Yes" "Yes" "Yes" ...

$ Consumer.disputed : Factor w/ 2 levels "No","Yes": 1 1 1 1 1 1 1 1 1 1 ...

$ Resolution.time.in.days: int 0 0 0 0 0 0 1 0 0 0 ...

$ Year : Factor w/ 2 levels "Earlier period",..: 2 1 1 2 2 2 2 2 1 2 ...

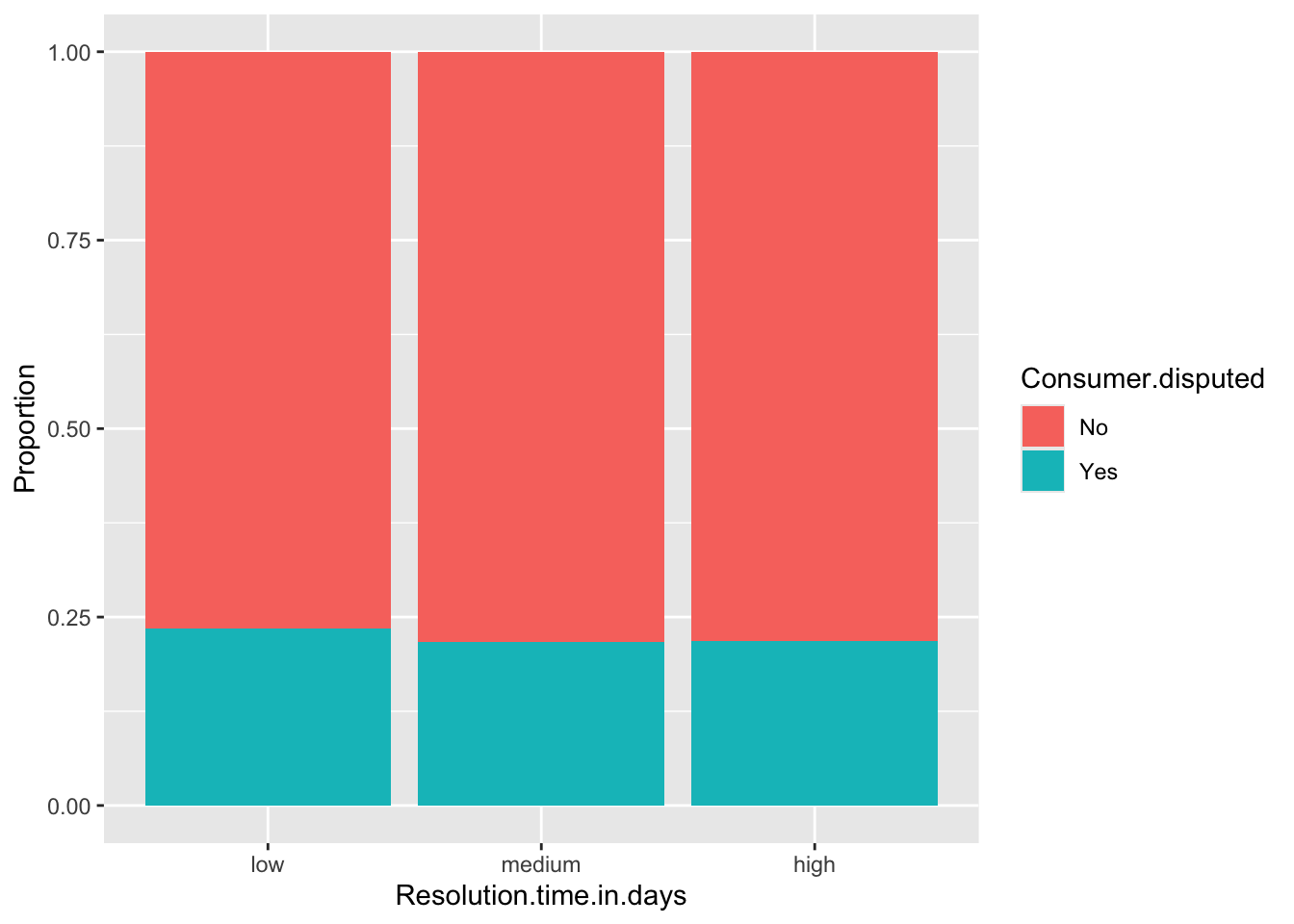

$ Quarter : chr "Q4" "Q1" "Q4" "Q1" ...The Resolution_time variable contains a significant number of zeros (8,316) along with other values. This imbalance caused issues when using the equal frequency method for binning. To address this, I first filtered out the non-zero values to determine the breaks within the data. Then, I added zero to this group.

As a result, we have three groups: low, medium, and high.

table(cc$Resolution.time.in.days)

0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

8316 1616 1122 844 491 473 318 222 83 35 47 37 21 18 18 18

16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31

9 10 16 15 12 22 9 6 13 6 7 2 10 16 5 9

32 33 34 35 36 37 38 39 40 41 42 43 45 46 47 48

14 9 9 11 12 3 3 7 3 8 3 8 5 2 5 1

49 50 51 52 55 56 57 60 61 63 64 65 66 67 68 70

5 3 3 1 6 2 1 2 4 2 1 2 1 1 1 1

72 76 77 79 83 90 93 95 98 106 151 286

1 1 1 1 1 1 1 1 1 1 1 1 non_zero_values <- cc$Resolution.time.in.days[cc$Resolution.time.in.days > 0]

breaks <- quantile(non_zero_values, probs = seq(0, 1, length.out = 3))

breaks <- c(0, breaks)

cc$Resolution.time.in.days <- cut(cc$Resolution.time.in.days, breaks = breaks, labels = c("low", "medium", "high"), include.lowest = TRUE)

table(cc$Resolution.time.in.days)

low medium high

9932 1966 2099 For the next few steps, we are going to be reducing the number of unique levels for some of our factor variables:

The Product column has 12 unique values, but we will use only the 6 most common ones.

length(unique(cc$Product))[1] 12top_6_Product <- cc %>%

count(Product, sort = TRUE) %>%

slice(1:6) %>%

select(Product)The Issue column contains 81 unique values, and we will use only the 7 most common ones. Also changed these 7 values to the shorter names.

length(unique(cc$Issue))[1] 81top_7_Issue <- cc %>%

count(Issue, sort = TRUE) %>%

slice(1:7) %>%

select(Issue)The State column has 60 unique values, and we will use the 10 most common ones.

length(unique(cc$State))[1] 60top_10_State <- cc %>%

count(State, sort = TRUE) %>%

slice(1:10) %>%

select(State)cc <- cc %>% filter(Product %in% top_6_Product$Product &

Issue %in% top_7_Issue$Issue &

State %in% top_10_State$State)

cc <- cc %>%

mutate(Issue = case_when(

Issue == "Account opening, closing, or management" ~ "Account Management",

Issue == "Application, originator, mortgage broker" ~ "Mortgage Application",

Issue == "Communication tactics" ~ "Communication",

Issue == "Credit reporting company's investigation" ~ "Credit Investigation",

Issue == "Deposits and withdrawals" ~ "Transactions",

Issue == "Loan modification,collection,foreclosure" ~ "Loan Modification",

Issue == "Loan servicing, payments, escrow account" ~ "Loan Servicing",

TRUE ~ Issue

))

nrow(cc)[1] 4110After reducing the unique levels, the dataset now contains 4110 rows.

str(cc)'data.frame': 4110 obs. of 9 variables:

$ Product : chr "Mortgage" "Mortgage" "Credit reporting" "Debt collection" ...

$ Issue : chr "Loan Servicing" "Mortgage Application" "Credit Investigation" "Loan Modification" ...

$ State : chr "FL" "FL" "CA" "NY" ...

$ Submitted.via : chr "Web" "Web" "Web" "Email" ...

$ Timely.response : chr "Yes" "Yes" "Yes" "Yes" ...

$ Consumer.disputed : Factor w/ 2 levels "No","Yes": 1 1 1 2 1 1 1 1 1 2 ...

$ Resolution.time.in.days: Factor w/ 3 levels "low","medium",..: 1 1 1 1 1 3 3 1 3 1 ...

$ Year : Factor w/ 2 levels "Earlier period",..: 2 2 2 1 2 1 2 2 2 1 ...

$ Quarter : chr "Q4" "Q2" "Q1" "Q4" ...cc$Product <- as.factor(cc$Product)

cc$Issue <- as.factor(cc$Issue)

cc$State <- as.factor(cc$State)

cc$Submitted.via <- as.factor(cc$Submitted.via)

cc$Timely.response <- as.factor(cc$Timely.response)

cc$Year <- as.factor(cc$Year)

cc$Quarter <- as.factor(cc$Quarter)Data Partitioning

After converting all variables to factor type, I partitioned the data into training(60%) and validation(40%) sets.

set.seed(79)

cc.index <- sample(c(1:nrow(cc)), nrow(cc)*0.6)

cc_train.df <- cc[cc.index, ]

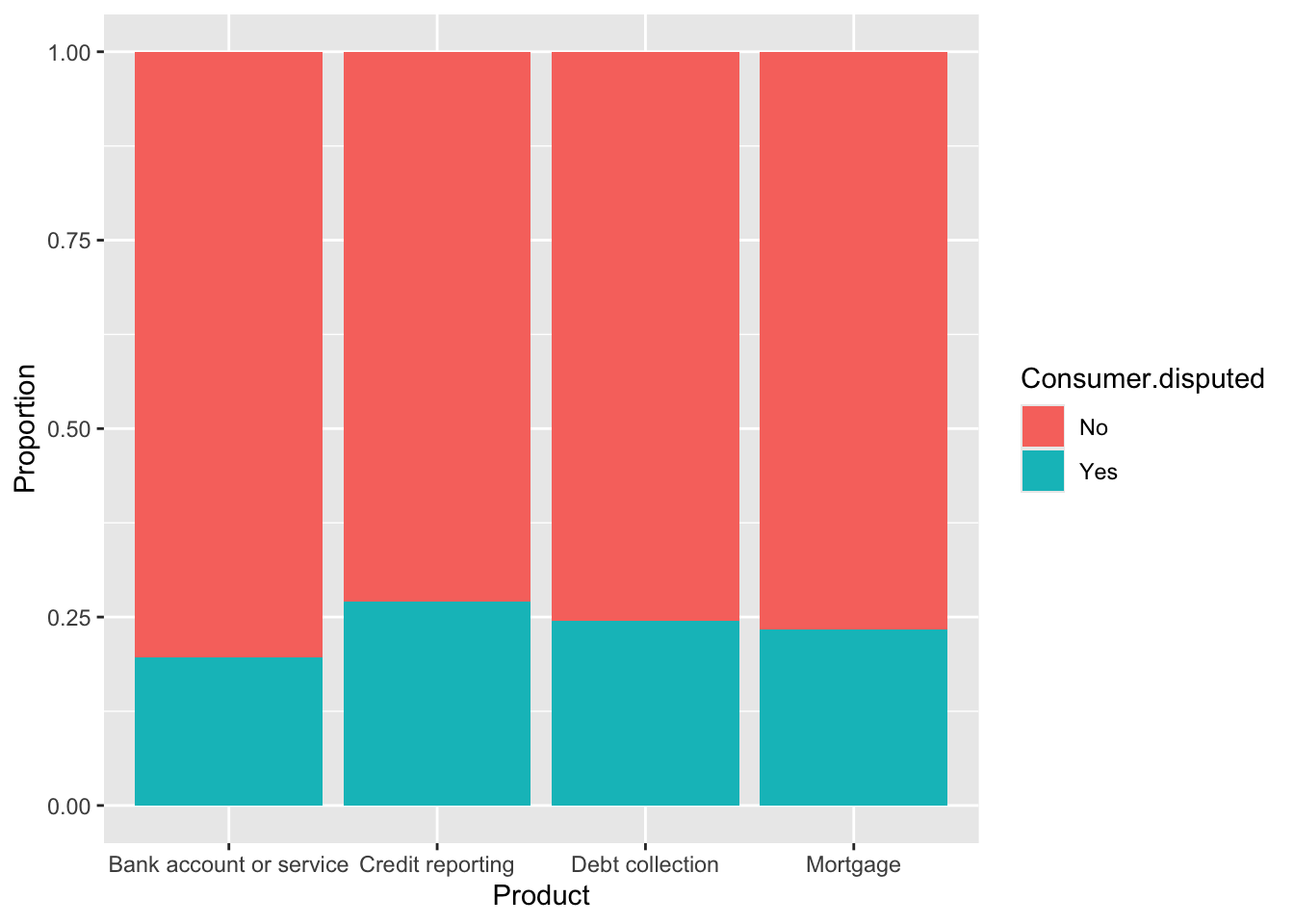

cc_valid.df <- cc[-cc.index, ]Data Visualization - Proportional Barplot

ggplot(cc_train.df, aes(x = Product, fill = Consumer.disputed)) +

geom_bar(position = 'fill') +

labs(x = "Product", y = "Proportion")

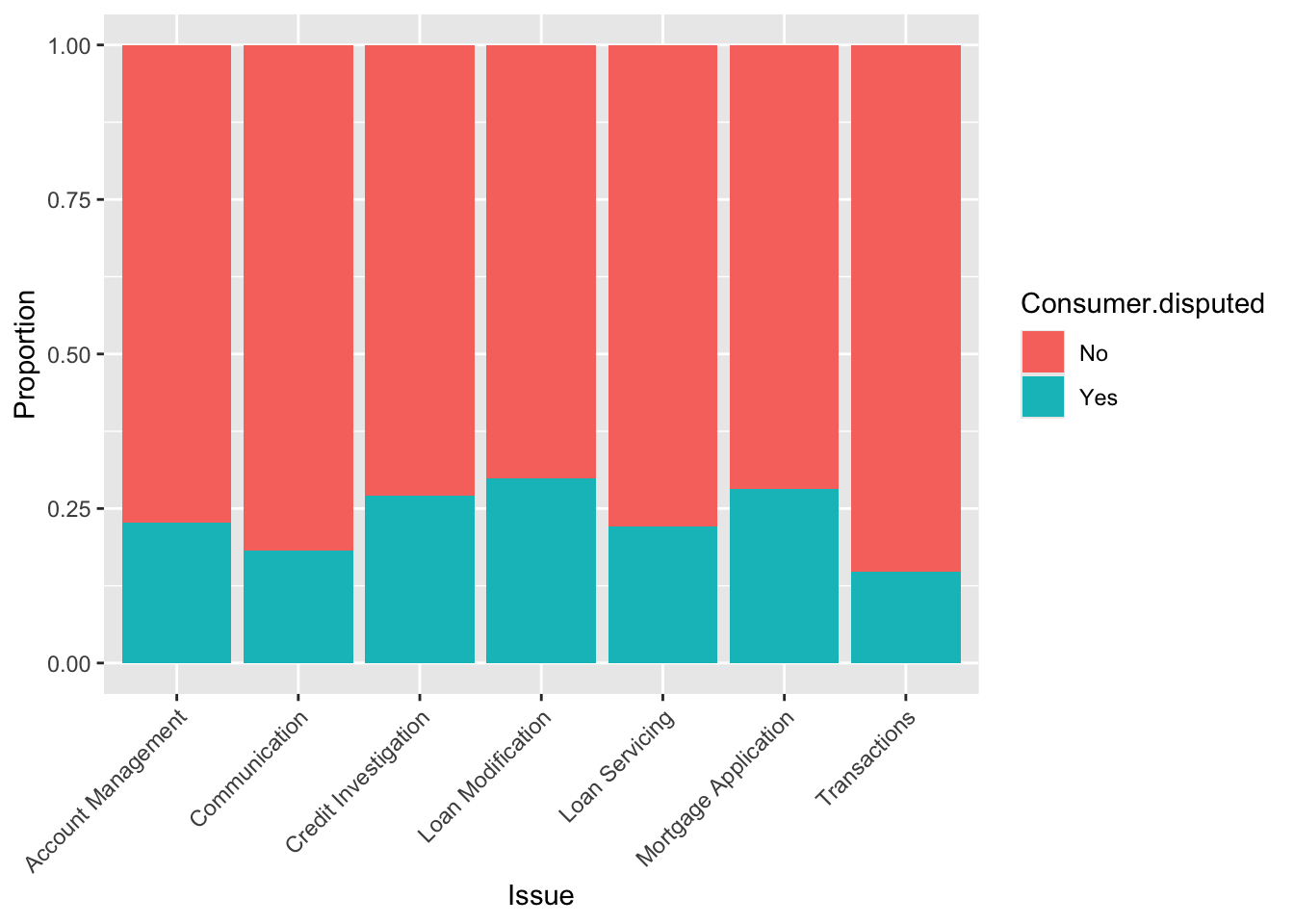

ggplot(cc_train.df, aes(x = Issue, fill = Consumer.disputed)) +

geom_bar(position = 'fill') +

# coord_flip() +

theme(axis.text.x = element_text(angle = 45, hjust = 1)) +

labs(x = "Issue", y = "Proportion")

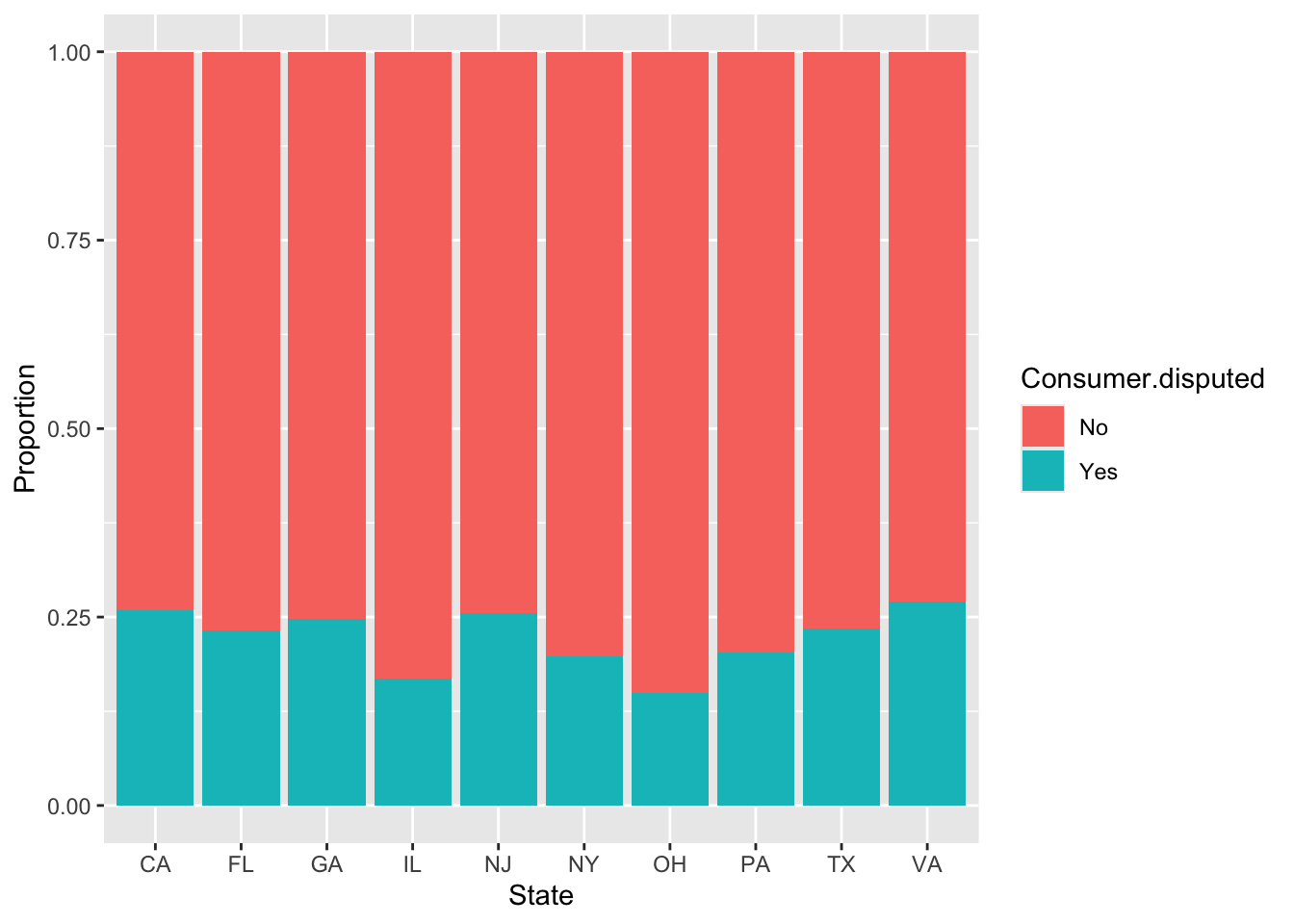

ggplot(cc_train.df, aes(x = State, fill = Consumer.disputed)) +

geom_bar(position = 'fill') +

labs(x = "State", y = "Proportion")

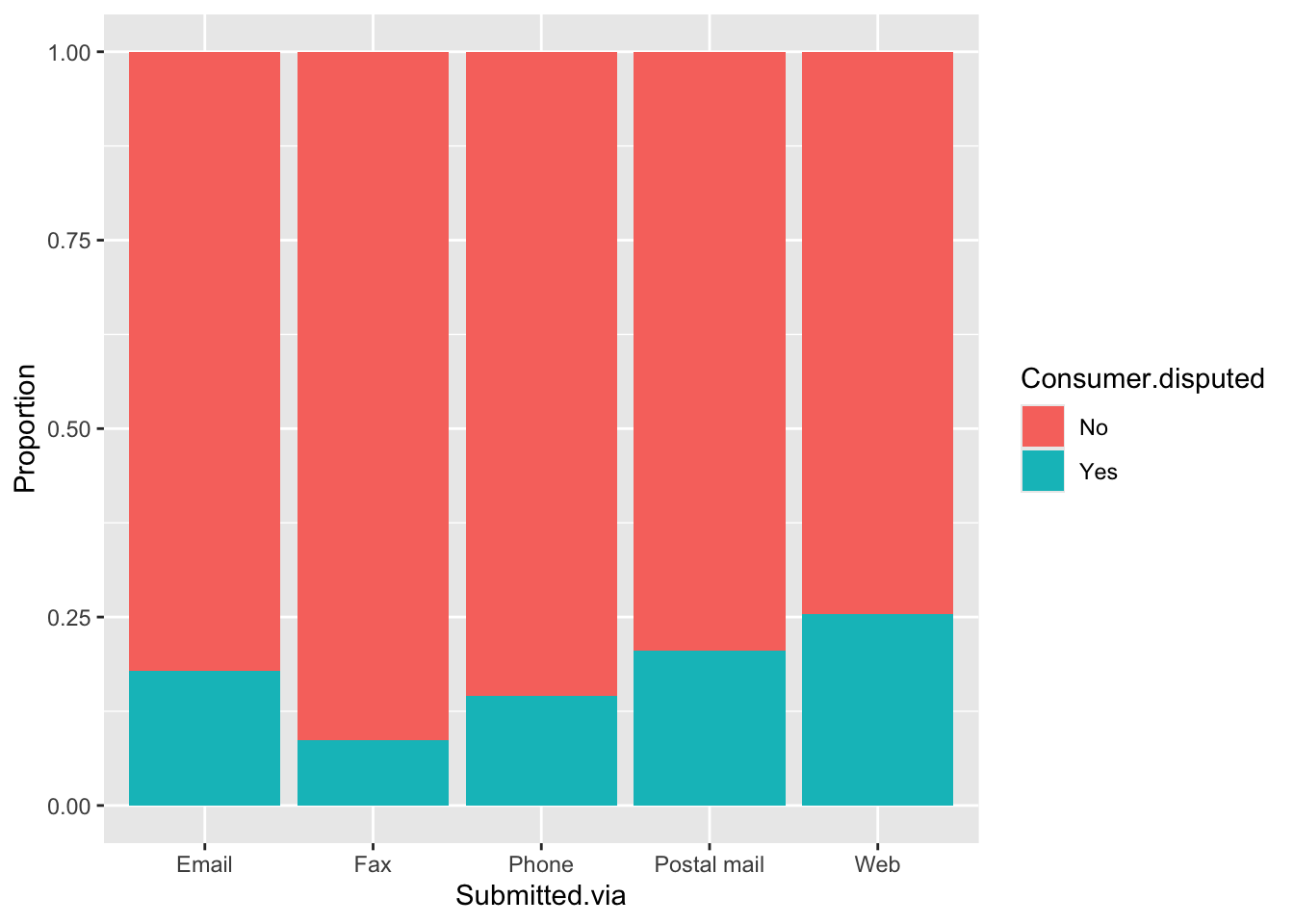

ggplot(cc_train.df, aes(x = Submitted.via, fill = Consumer.disputed)) +

geom_bar(position = 'fill') +

labs(x = "Submitted.via", y = "Proportion")

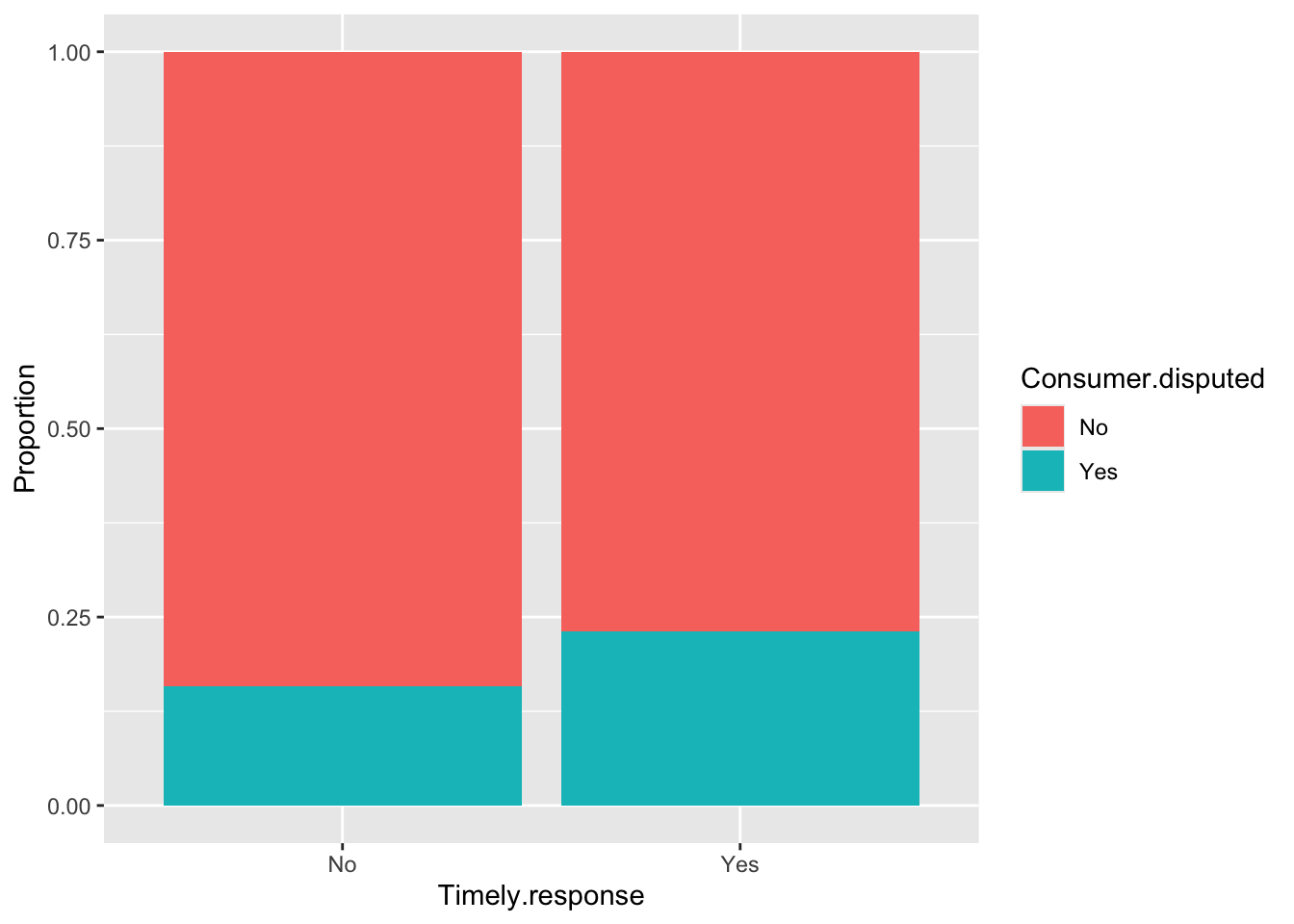

ggplot(cc_train.df, aes(x = Timely.response, fill = Consumer.disputed)) +

geom_bar(position = 'fill') +

labs(x = "Timely.response", y = "Proportion")

ggplot(cc_train.df, aes(x = Year, fill = Consumer.disputed)) +

geom_bar(position = 'fill') +

labs(x = "Year", y = "Proportion")

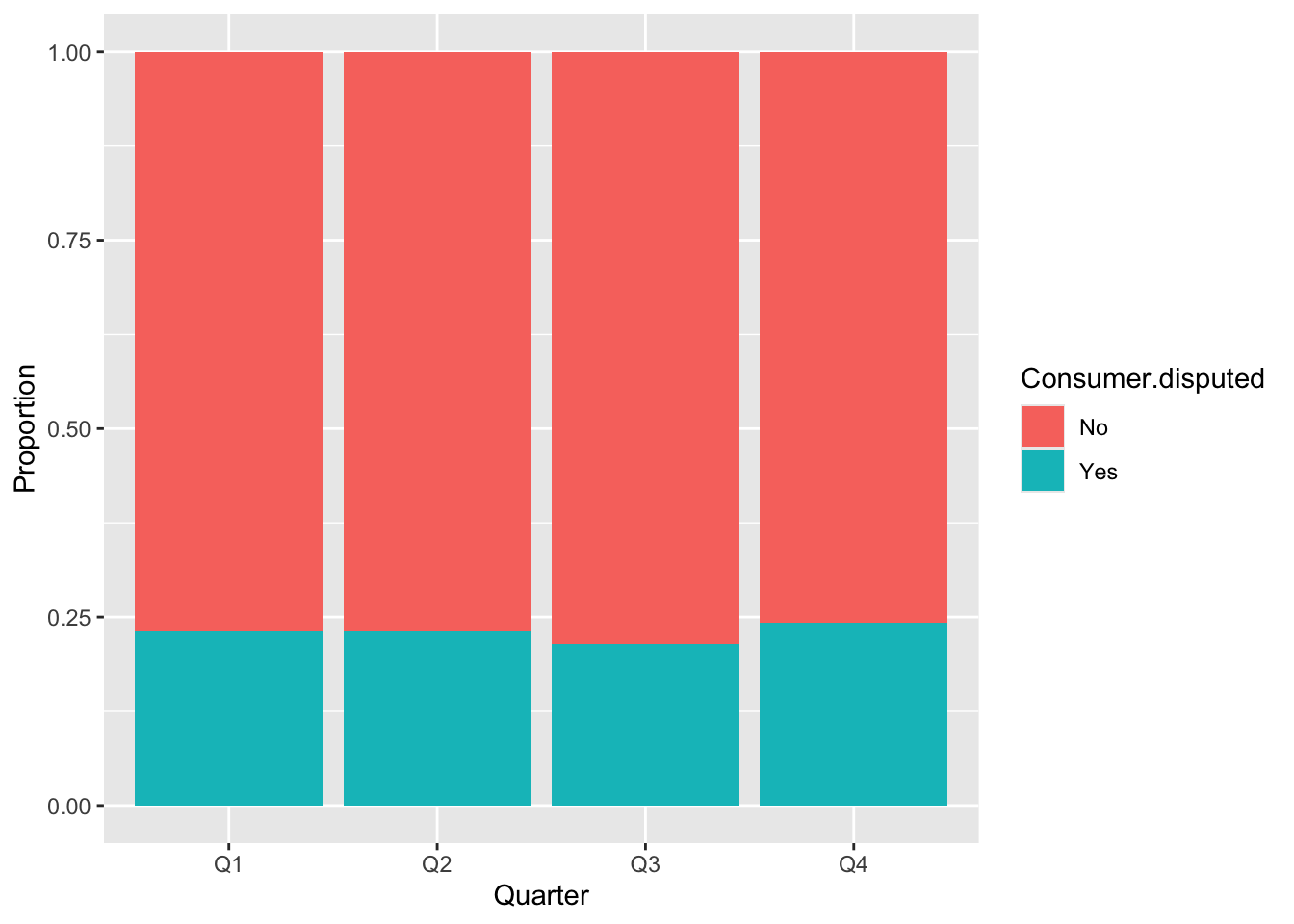

ggplot(cc_train.df, aes(x = Quarter, fill = Consumer.disputed)) +

geom_bar(position = 'fill') +

labs(x = "Quarter", y = "Proportion")

ggplot(cc_train.df, aes(x = Resolution.time.in.days, fill = Consumer.disputed)) +

geom_bar(position = 'fill') +

labs(x = "Resolution.time.in.days", y = "Proportion")

For the Year variable, we observed a similar proportion between time periods and whether consumers disputed or not. The same applies to the Quarter variable, with only a small difference in the third quarter. Timely.response showed better result with noticeable differences between values compared to Resolution.time.in.days. For the remaining variables, we can see distinct differences between categories.

I will remove Resolution.time.in.days, because of the imbalance of values in dataset.

cc_train.df <- cc_train.df %>% select(-Year, -Quarter, -Resolution.time.in.days)

str(cc_train.df)'data.frame': 2466 obs. of 6 variables:

$ Product : Factor w/ 4 levels "Bank account or service",..: 3 1 4 3 4 3 1 3 3 4 ...

$ Issue : Factor w/ 7 levels "Account Management",..: 2 1 5 4 5 4 1 2 2 5 ...

$ State : Factor w/ 10 levels "CA","FL","GA",..: 2 5 2 8 8 5 4 3 9 1 ...

$ Submitted.via : Factor w/ 5 levels "Email","Fax",..: 5 5 5 4 5 4 1 5 5 5 ...

$ Timely.response : Factor w/ 2 levels "No","Yes": 2 2 2 2 2 2 2 2 2 2 ...

$ Consumer.disputed: Factor w/ 2 levels "No","Yes": 1 1 1 2 1 1 1 1 1 1 ...cc.nb <- naiveBayes(Consumer.disputed ~.,data = cc_train.df)

cc.nb

Naive Bayes Classifier for Discrete Predictors

Call:

naiveBayes.default(x = X, y = Y, laplace = laplace)

A-priori probabilities:

Y

No Yes

0.7704785 0.2295215

Conditional probabilities:

Product

Y Bank account or service Credit reporting Debt collection Mortgage

No 0.27210526 0.08368421 0.22473684 0.41947368

Yes 0.22261484 0.10424028 0.24558304 0.42756184

Issue

Y Account Management Communication Credit Investigation Loan Modification

No 0.15947368 0.11105263 0.08368421 0.11368421

Yes 0.15724382 0.08303887 0.10424028 0.16254417

Issue

Y Loan Servicing Mortgage Application Transactions

No 0.34421053 0.07526316 0.11263158

Yes 0.32862191 0.09893993 0.06537102

State

Y CA FL GA IL NJ NY

No 0.22578947 0.15631579 0.07210526 0.06526316 0.06000000 0.11789474

Yes 0.26501767 0.15901060 0.07950530 0.04416961 0.06890459 0.09717314

State

Y OH PA TX VA

No 0.06000000 0.06000000 0.12736842 0.05526316

Yes 0.03533569 0.05123675 0.13074205 0.06890459

Submitted.via

Y Email Fax Phone Postal mail Web

No 0.176315789 0.011052632 0.089473684 0.042631579 0.680526316

Yes 0.128975265 0.003533569 0.051236749 0.037102473 0.779151943

Timely.response

Y No Yes

No 0.01684211 0.98315789

Yes 0.01060071 0.98939929str(cc_train.df)'data.frame': 2466 obs. of 6 variables:

$ Product : Factor w/ 4 levels "Bank account or service",..: 3 1 4 3 4 3 1 3 3 4 ...

$ Issue : Factor w/ 7 levels "Account Management",..: 2 1 5 4 5 4 1 2 2 5 ...

$ State : Factor w/ 10 levels "CA","FL","GA",..: 2 5 2 8 8 5 4 3 9 1 ...

$ Submitted.via : Factor w/ 5 levels "Email","Fax",..: 5 5 5 4 5 4 1 5 5 5 ...

$ Timely.response : Factor w/ 2 levels "No","Yes": 2 2 2 2 2 2 2 2 2 2 ...

$ Consumer.disputed: Factor w/ 2 levels "No","Yes": 1 1 1 2 1 1 1 1 1 1 ...Confusion Matrix

Comparing the accuracy metrics, the validation set achieved 74.45%, which is lower than the training set’s 77.05%. However, both sets reveal that the model predominantly predicts ‘No’ for all instances (100%). a.The model predicts ‘No’ for every case and never predicts ‘Yes’, indicating an imbalance among predictions. Although the accuracy appears relatively high, it is misleading as it reflects the model’s bias rather than its true predictive power.

confusionMatrix(predict(cc.nb, newdata=cc_train.df), cc_train.df$Consumer.disputed)Confusion Matrix and Statistics

Reference

Prediction No Yes

No 1900 566

Yes 0 0

Accuracy : 0.7705

95% CI : (0.7534, 0.7869)

No Information Rate : 0.7705

P-Value [Acc > NIR] : 0.5113

Kappa : 0

Mcnemar's Test P-Value : <2e-16

Sensitivity : 1.0000

Specificity : 0.0000

Pos Pred Value : 0.7705

Neg Pred Value : NaN

Prevalence : 0.7705

Detection Rate : 0.7705

Detection Prevalence : 1.0000

Balanced Accuracy : 0.5000

'Positive' Class : No

confusionMatrix(predict(cc.nb, newdata=cc_valid.df), cc_valid.df$Consumer.disputed)Confusion Matrix and Statistics

Reference

Prediction No Yes

No 1224 420

Yes 0 0

Accuracy : 0.7445

95% CI : (0.7227, 0.7655)

No Information Rate : 0.7445

P-Value [Acc > NIR] : 0.5131

Kappa : 0

Mcnemar's Test P-Value : <2e-16

Sensitivity : 1.0000

Specificity : 0.0000

Pos Pred Value : 0.7445

Neg Pred Value : NaN

Prevalence : 0.7445

Detection Rate : 0.7445

Detection Prevalence : 1.0000

Balanced Accuracy : 0.5000

'Positive' Class : No

Naive Rule vs Naive Bayes

Naive rule in classification is to classify the record as a member of majority class. If we had used the naive rule for classification, we would classify all records in the training set as “No” because “No” is the most frequent class.

Our Naive Bayes model, which follows the naive rule approach, assigns all cases as “No.” Both methods yield the same accuracy of 77.05%, resulting in a 0% difference between them.

I think imbalance plays a big role here. As described in the book, the absence of this predictor actively “outvotes” any other information in the record to assign a “No” to the outcome value (when, in this case, it has a relatively good chance of being a “Yes”). Also, as a customer, I often choose not to dispute issues to avoid wasting energy. It’s usually easier to let things go rather than engage in disputes, especially if the potential outcome doesn’t seem worth the effort. Maybe it’s a reason why we don’t have meaningful data.

Scoring data using Naive Bayes

I took 25 records by sorting the probability for the “Yes” column in descending order, selecting the top 25 as the most likely to belong to the “YES” group.

Among these 25 records, 5 records truly belong to “Yes” group. The accuracy for these predictions = 80%. Even though the model didn’t predict any “Yes” values, it still achieved 80% accuracy by correctly classifying 20 out of 20 “No” records. Since the “Yes” group is a small portion of the dataset, its impact on accuracy is minimal. Compared to accuracy of overall model 74.45%, these selected proportion of data have relatively high value.

pred.prob <- predict(cc.nb, newdata=cc_valid.df, type="raw")

# pred.prob

pred.class <- predict(cc.nb, newdata=cc_valid.df)

# pred.class

df <- data.frame(actual=cc_valid.df$Consumer.disputed,

predicted=pred.class, pred.prob)

valid_25 <- df %>% arrange(desc(Yes)) %>% slice(1:25)

table(valid_25$actual)

No Yes

20 5 valid_25 %>% filter(actual == 'Yes') actual predicted No Yes

1 Yes No 0.5992883 0.4007117

2 Yes No 0.6009522 0.3990478

3 Yes No 0.6009522 0.3990478

4 Yes No 0.6137075 0.3862925

5 Yes No 0.6137075 0.3862925Identifying this subset of records helps us to see that the model completely fails at identifying “Yes” cases. On the other hand, by assigning all records to the majority class “No,” the model achieves high accuracy, performing well in most cases. By identifying this main issue, we can focus on other ways to dealing with imbalanced data or try other models.

Manual calculation of probability

my_data <- cc_train.df[45,]

my_data Product Issue State Submitted.via Timely.response

3560 Mortgage Mortgage Application IL Web No

Consumer.disputed

3560 Nopredict(cc.nb, my_data)[1] No

Levels: No Yespredict(cc.nb, my_data, type="raw") No Yes

[1,] 0.8370455 0.1629545cc.nb

Naive Bayes Classifier for Discrete Predictors

Call:

naiveBayes.default(x = X, y = Y, laplace = laplace)

A-priori probabilities:

Y

No Yes

0.7704785 0.2295215

Conditional probabilities:

Product

Y Bank account or service Credit reporting Debt collection Mortgage

No 0.27210526 0.08368421 0.22473684 0.41947368

Yes 0.22261484 0.10424028 0.24558304 0.42756184

Issue

Y Account Management Communication Credit Investigation Loan Modification

No 0.15947368 0.11105263 0.08368421 0.11368421

Yes 0.15724382 0.08303887 0.10424028 0.16254417

Issue

Y Loan Servicing Mortgage Application Transactions

No 0.34421053 0.07526316 0.11263158

Yes 0.32862191 0.09893993 0.06537102

State

Y CA FL GA IL NJ NY

No 0.22578947 0.15631579 0.07210526 0.06526316 0.06000000 0.11789474

Yes 0.26501767 0.15901060 0.07950530 0.04416961 0.06890459 0.09717314

State

Y OH PA TX VA

No 0.06000000 0.06000000 0.12736842 0.05526316

Yes 0.03533569 0.05123675 0.13074205 0.06890459

Submitted.via

Y Email Fax Phone Postal mail Web

No 0.176315789 0.011052632 0.089473684 0.042631579 0.680526316

Yes 0.128975265 0.003533569 0.051236749 0.037102473 0.779151943

Timely.response

Y No Yes

No 0.01684211 0.98315789

Yes 0.01060071 0.98939929no_score <- 0.7704785 * 0.41947368 * 0.07526316 * 0.06526316 * 0.680526316 * 0.01684211

yes_score <- 0.2295215 * 0.42756184 * 0.09893993 * 0.04416961 * 0.779151943 * 0.01060071

no_score/(no_score + yes_score)[1] 0.8370455I selected 45th row from training set.

- Actual Consumer.disputed outcome is “No”

- The model’s predicted answer is “No”

- The probability for “No” is 0.8370455, “Yes” is 0.1629545.